12 Questions to Ask Your Prospective Lender

1. Are you a lender or a broker?

Sometimes businesses will market themselves as lenders when they are just brokering the loan. Why is this problematic? Because any commitments they make concerning timing and funding are not fully within their control. They are not the final decision makers and therefore cannot guarantee that a loan will be funded. A borrower who wants to confirm that they are dealing with a lender versus a broker can check the local land records and see if the lender’s name appears in the land records as having originated loans previously. In addition, some lenders sell loans as well. The borrower should ask the lender if he intends to keep the loan in-house or sell it.

A borrower should seek a lending relationship with a lender who is funding loans directly rather than a broker masquerading as a lender. Pimlico Capital is a direct lender that (1) never failed to fund a loan based on our commitment and (2) never sold a loan to a third party.

2. Do you have references that you can provide to me?

3. How long have you been in business?

If the prospective lender just got into the private hard money lending business, he has no proven track record. This is not a risk a borrower should take, particularly when the need for funding is immediate.

Pimlico Capital was established in April 2016. With four years of experience already under our belt, we have established ourselves as a reputable industry player. We have experienced growth in business thanks in large part to referrals and repeat business.

4. How long does it take to get a term sheet?

5. What fees will I have to pay?

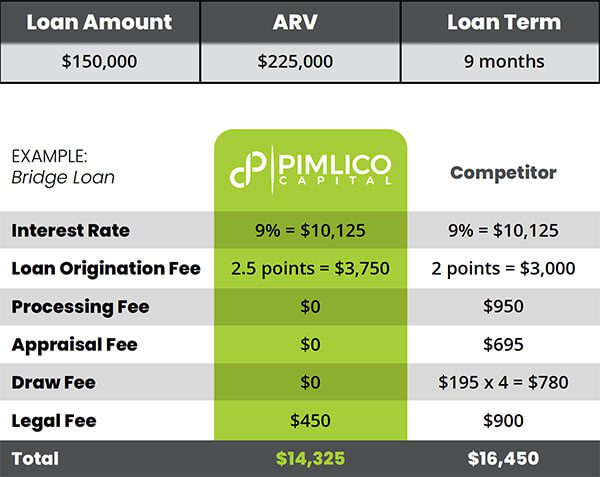

Sometimes prospective customers will compare our rates to a competitor’s rates and question us as to why our rates are higher. What they are not taking into consideration is that our competitor has extra fees that are not disclosed in their marketing materials whereas we are fully transparent regarding any fees that the borrower will incur. For example, look at the comparison below:

Savings with Pimlico Captial

$2,125

What is even more troublesome than the fact that some private money lenders charge these fees is that the borrower may not even find out about them until they are at the closing table and are seeing the final HUD-1.

At Pimlico Capital:

- We mostly work with experienced real estate investors, which lowers our risk.

- We are working with our internal funds, so we are the final decision makers and do not need to consult with or comply with anyone else in making our lending decisions, restrictions and rules. We do not have to promise outside investors higher rates of return.

- We do not use or charge for third party appraisals.

- We underwrite in-house and do not need to spend resources communicating back and forth with other parties.

This means that we can make our services available for a lower cost than our competitors can.

6. Is there a pre-payment penalty?

The borrower may also be optimistic about paying off the loan before it matures, but blissfully unaware that his lender charges a hefty prepayment penalty. It is therefore important that the borrower do his due diligence and ask the question. At Pimlico Capital, there is no pre-payment penalty.