Since 2016, Pimlico Capital has been providing funds for real estate investors to help them leverage their investments and achieve optimal cash flow. Our company was founded in Baltimore, Maryland by real estate investors who understand the ins and outs of the real estate industry, and are passionate about transforming the lending process.

In addition to offering competitive low rates and high leverage loan options, the team at Pimlico Capital is dedicated to providing the best possible experience for our valued partners. In our view, your success is our success. From the origination process through closing and the lifetime of your loan, we aim to be as helpful as possible at every step of the way.

Whether you prefer to fix and flip, fix and hold, BRRRR, or acquire turnkey rental properties, Pimlico Capital can help you succeed and grow your business.

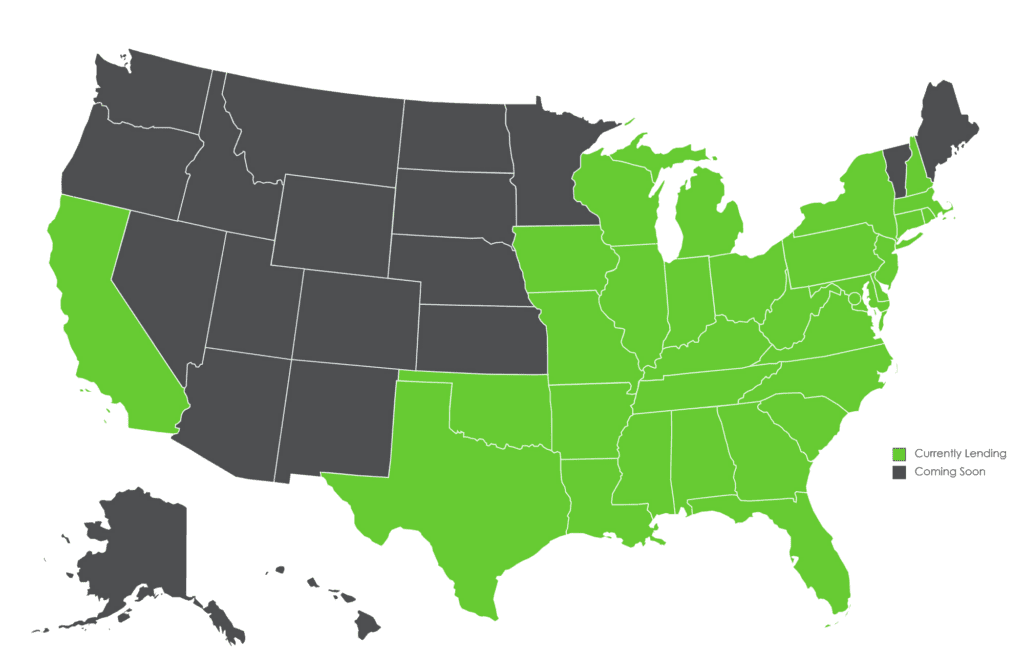

While we’re located in Baltimore, Maryland, we’re able to serve real estate investors in more than 30 states, and we hope to add to our service area soon! Check below to see if we’re currently lending in your state — even if not, be sure to give us a call at 410-855-4600 to double check.

At Pimlico Capital, we work hard to meet and exceed our partners’ expectations. We’re also working hard to revolutionize private lending by streamlining the lending process through technology, all while communicating effectively both internally and externally. We’re a small but quickly growing team, and we’re always looking out for motivated individuals who can help!

© Pimlico Capital 2024. All rights reserved.

*All loans subject to underwriting and approval.

Rates may change with market conditions.