For decades, scientists have been arguing about whether or not climate change is human-induced or part of a natural cycle – or perhaps a combination of both. Regardless of where you fall on this spectrum of viewpoints, the reality is that various areas of the United States (as well as the globe at large) are experiencing natural phenomena that are having a pronounced impact on real estate markets. Parts of the US are seeing record droughts and wildfires, while some coastal areas are seeing higher tides and eroding shorelines. Human-induced or not, our environment is constantly changing, and it would be wise as a real estate investor to develop an understanding as to how things are changing and what the implications are for various investment markets.

Increased Risk of Natural Disasters Means Higher Insurance Premiums

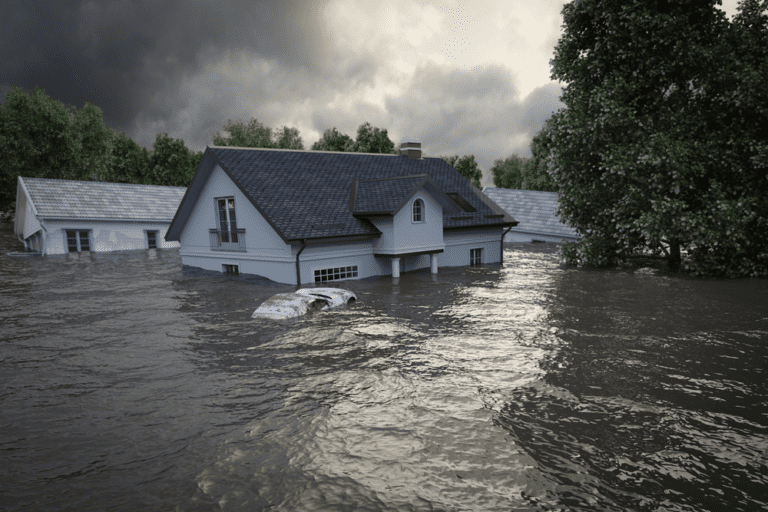

It’s no secret that properties at risk of flooding carry higher insurance premiums due to the increased risk of water damage. It stands to reason, then, that properties in areas that are prone to tornadoes, wildfires, hurricanes, and other natural disasters would also follow the same trend. For this reason, it’s important to understand the climate risks that may come with any investment properties that you’re considering. Is it in a floodplain? Is it on a coastal area that’s experiencing rapid erosion? Is there a higher chance of hurricanes striking the area that the property is located in? If so, you can expect to pay higher insurance premiums, and should be prepared to cover damages in your properties in case they are damaged due to a disaster. This may also make the process more complex for securing long-term rental property financing.

In some cases, the additional costs may not be worth the risk of investing in a particular area – even if you’ve found an incredibly desirable property at a reasonable price. Sometimes, if the price seems too good to be true, there’s a reason for that, and it’s always important to look into why that may be the case.

Real Estate Prices Can be Affected by Changing Weather Patterns

If a luxurious beachfront property is being sold at what seems like a discounted price, the first question you should ask yourself is, “Why?” Often, you can find the answer by taking a look at recent climate events in the area. If a property was once extremely desirable and is now being sold at a discount, chances are that there are external factors driving the price down, and climate can be a big factor in certain areas. Maybe flooding is occurring more frequently, or more Hurricanes are headed towards a particular place, making it less desirable to live in that area. Generally, whoever is selling the property has a reason for offering it at a discount, and you’ll want to fully understand the risks you’re taking on by agreeing to a purchase in an area where weather patterns are changing and shaping the local landscape. Conversely – look for temperate areas where there is low risk, and you may find some excellent value by figuring out what areas people are likely to move to when the weather gets too bad to stay put.

Government Regulations on Climate Can Impact Real Estate Investors

Whether federal, state, or local, governments of all levels in various locations are taking aim at climate change from a legislative perspective. For example, many state and local governments have passed mandates relating to energy efficiency for newly developed or renovated properties. This can drive investment costs up, making individual projects less profitable and therefore less attractive to investors. In other cases, land that was once open for development may now be considered an important natural resource to support the local ecosystem, or protect native species of plants and wildlife.

The push to build a more sustainable or “green” future has merits in many ways, and a lot of consumers have a preference for energy efficient dwellings and workplaces. After all, it’s easier to save money on energy costs when your home is well-insulated and has energy efficient windows and HVAC. So in some cases, additional investment costs are justified – but in any case, it’s best to know what local regulations you may be subject to when planning fix & flip projects.

Being Able to Adapt to Changes is Key

Maybe you’ve had your heart set on investing in a certain area, only to find after a few years that wildfires or hurricanes are posing a serious risk to your investments. If you understand the risk and proceed forward with your plan anyway, and an event occurs that leads to a financial loss, you’ll probably end up wishing that you’d changed up your plans. With this in mind, it’s important to understand that adaptability is a major strength in times like these. Sometimes, even if you have your heart set on something you’ll need to use your brain to overpower your emotions to make the smarter decision.

Investing in real estate isn’t easy, but by surrounding yourself with the right people, you can make it easier for yourself to reach your goals. If you’re looking for a hard money lender you can trust, give Pimlico Capital a call at 410-855-4600, or get a quote from our rate calculator. We’re here to form long-lasting relationships and ensure our partners’ success. Experience the difference for yourself on your next investment!