DSCR: What it is and Why it Matters for Real Estate Investing

Real estate investing involves a healthy amount of alphabet soup – tons of industry-specific acronyms for investors to keep track of. Experienced investors are probably very well aware of what DSCR stands for, but even still, we tend to get questions about why this metric is so important. So, in an effort to peel back […]

Best Use Cases for 30-Year Rental Investment Loans

There are a lot of different ways to successfully invest in real estate, but for the purposes of this article, we’re going to talk specifically about long-term investment strategies and when 30-year rental investment loans tend to work best for investors. Whether purchasing or refinancing, there are several scenarios where taking out a long-term rental […]

Three Great Reasons to Lock In a Long-Term Rental Loan ASAP

Perhaps this goes without saying, but the last couple of years have been… hectic. Thanks to a global pandemic leading to massive economic shutdowns as a means of avoiding a catastrophic public health event, times have been tough for a lot of home and business owners. Monetary policy has been at the forefront of the […]

Tips for Accurately Estimating ARV on a Fix & Flip

As any experienced real estate investor knows, accurately estimating the after repair value (ARV) for a fix & flip project is crucial to project success. Having an accurate ARV can not only give you a better picture of how much profit you can take away from the project, but it’s also the number that most […]

Top 5 Benefits of Working With a Hard Money Lender

As most experienced real estate investors know, getting started with a project can require quite a bit of capital funding. In the past, it used to make sense to always go to your local bank or credit union to seek business loans to fund investment projects. But ever since the housing market crisis of the […]

How the End of Covid Forbearance May Impact the Housing Market

When the Covid-19 pandemic hit the United States, lawmakers knew that steps needed to be taken very quickly to allay the effects that a massive economic shutdown would have on the financial health of American citizens. As a result, the US Government set up a mortgage forbearance program for homeowners who would inevitably struggle to […]

What is Normal Wear and Tear for a Rental Property?

A tenant’s lease is up, and the landlord finds the now vacated unit in a state of disrepair. The landlord notifies the tenant of the issues and advises the tenant that the security deposit will not be returned. The tenant fires back a response that there is no damage—just “normal wear and tear.” Who’s right? […]

What Does the Latest Eviction Ban Mean for Tenants & Landlords?

Last week, the CDC announced that it will be extending an eviction ban in counties “experiencing substantial and high level of community transmission” of COVID-19, which is expected to cover 90% of renters throughout the United States through October 3, 2021. Naturally, this is a huge relief to tenants who are struggling to pay their […]

Tips for a Smooth & Successful Appraisal Process

Though we’ve previously discussed best practices for appraisals, as well as best practices for pre-sale inspections, there’s still more to be said about the appraisal process and making sure that it goes off without a hitch. In investing, the appraisal process is crucial to ensuring that you’re getting the most out of the work that […]

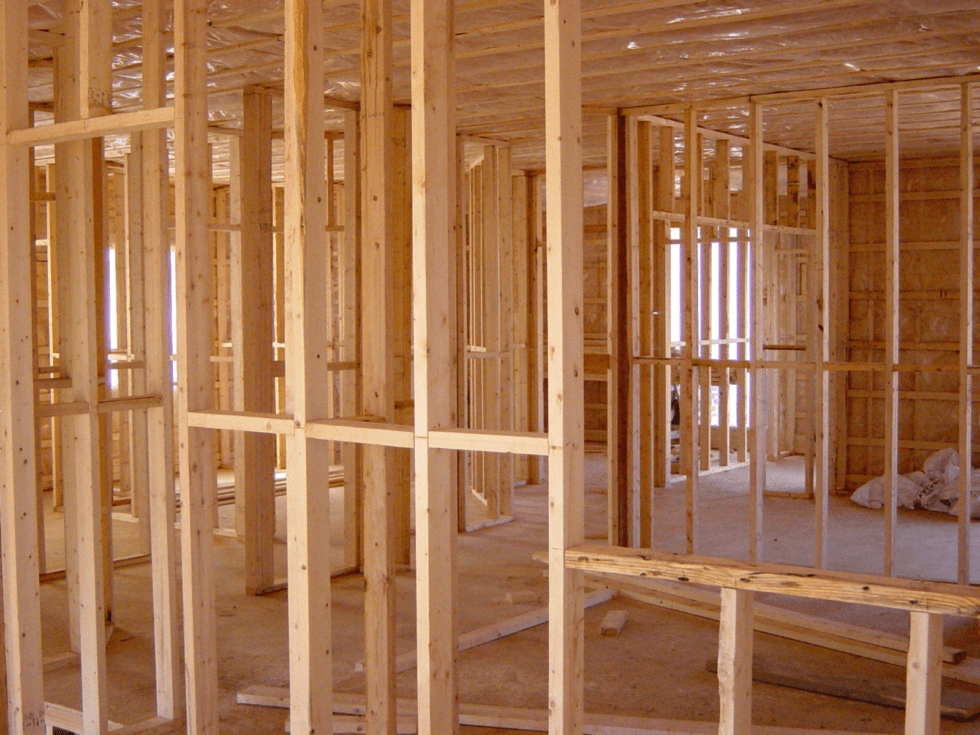

Why Did Lumber Prices Get So High?

Thanks to the global COVID-19 pandemic, consumers have borne witness to some bizarre economic events over the last year and a half. A stock market crash in March of 2020 was immediately followed by a meteoric recovery. Toilet paper, hand sanitizer, and cleaning supplies (among other consumer goods) were nearly impossible to find for several […]