Thanks to the global COVID-19 pandemic, consumers have borne witness to some bizarre economic events over the last year and a half. A stock market crash in March of 2020 was immediately followed by a meteoric recovery. Toilet paper, hand sanitizer, and cleaning supplies (among other consumer goods) were nearly impossible to find for several weeks or months. While some of these effects were somewhat predictable given the circumstances, one effect that caught everyone by surprise was a nearly 400% rise in the price of lumber. While those prices have come back down to earth since their peak in May of 2021, the question still remains: Why did lumber prices get so high?

The Conflation of Home and Office

As mask mandates and social distancing requirements were put into place, between 60 and 70% of Americans found themselves with their commutes reduced to a short walk from their beds to their couches. Some were told they would never have to return to an office again. City dwellers who appreciated living close to the office were suddenly no longer bound by proximity to their employers, while others found themselves stuck at home without their own private space.

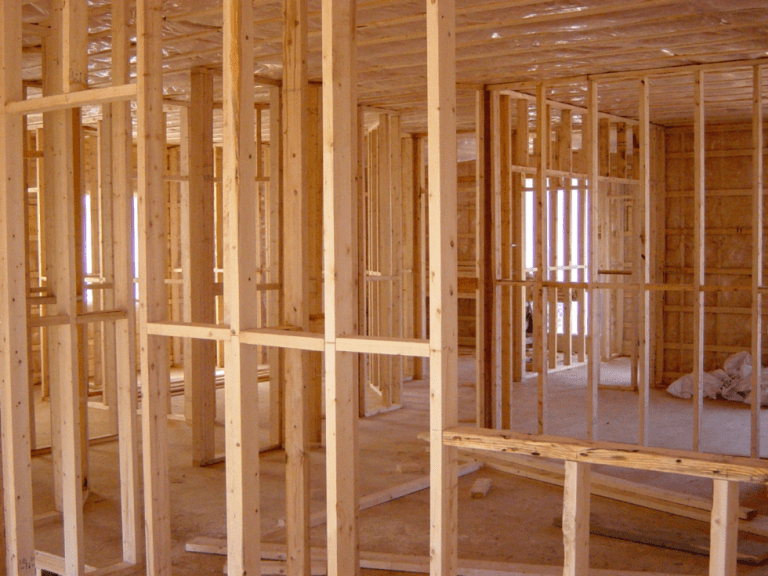

Add in factors like record-low mortgage rates and stimulus payments from the federal government, and suddenly the US experienced a boom in home remodels and new home construction, causing demand for lumber to skyrocket.

Not Enough Lumber to Go Around

In addition to a boom in demand, there was a corresponding supply shortage that had been building for almost two full decades. Roughly 20 years ago, British Columbia experienced a plague of pine beetles that wiped out nearly 60% of its lumber supply, causing long-term shortages. After the Great Recession of 2007-2009, new homebuilding came to a virtual standstill, causing a 49% drop in demand for lumber. In 2017-2018, another 6.2 million acres of Canadian lumber were destroyed by wildfires. Lastly, leading into the pandemic itself, commodity investors took short positions on lumber futures predicting yet another slump in demand. Suppliers took this as a hint that they should cut back on production, and did so, cutting back capacity by 40%.

Unfortunately, once it became clear that demand was not in fact going down, lumber mills simply could not produce fast enough to keep up with booming demand. This perfect storm of factors began to drive prices up in August of 2020, leading to lumber reaching its peak price point of nearly $1,700 per 1,000 board feet in May of 2021.

Lingering Effects on the Housing Market

Naturally, lumber is a very important commodity within the housing market. As the price of lumber soared, the average price of a new single-family home increased by about $36,000. For multifamily homes, this added about $13,000 to the average price of new units, causing an average increase in rent of almost $120 per month. While the housing market has seen effects of other external factors driving prices up, lumber prices certainly have not done anything to keep housing prices stable.

Has the Lumber Bubble Burst?

While lumber prices are still over 200% higher than they were in May of 2020, they have been falling steadily within the last month, signaling that the market is leveling out. However, experts predict that, rather than falling back to pre-pandemic levels, lumber prices may remain at a higher price point for some time to come. What that price will be remains to be seen, and could take a few months to determine as the dust continues to settle from recent market volatility.

Bear in mind that the housing market is still red hot, with many calling for more homes to be built to offset the recent surge in demand and bring prices back down to earth. A surge in homebuilding activity is likely to keep upward pressure on lumber prices, so it may be too soon to say that the bubble has burst entirely.

How Lumber Prices Affect Real Estate Investments

Despite the recent roller coaster in lumber prices and home values as a result, real estate investors can expect renovation and construction costs to soften, which will bring an increase in profit as home values remain high. For those who may have purchased lumber at peak prices, there’s still profit to be taken from fix and flip projects. Likewise, rental owners are finding that their property values are up, giving them more flexibility with cash-out refinancing options. Overall, 2021 continues to be a great year for real estate investors as borrowing rates remain low, and we expect this trend to continue for the foreseeable future.