How Many Cash-Flowing Properties Do You Need in Order to Retire Early?

Early retirement has become an increasingly desirable goal for many individuals seeking financial independence and a better work-life balance. One effective strategy to achieve this is through investing in cash-flowing properties. In this blog, we will delve into the concept of cash-flowing properties as a means to retire early, examine how many properties an investor might need, and provide a formula for readers to assess their own cash flow versus expenses.

Understanding Cash-Flowing Properties:

Cash-flowing properties are real estate investments that generate positive cash flow after deducting all expenses associated with the property, such as mortgage payments, property taxes, maintenance costs, and property management fees. Positive cash flow means that the rental income from the property exceeds its expenses, providing the investor with a regular stream of income.

The goal of acquiring cash-flowing properties is to build a portfolio that generates sufficient passive income to cover living expenses, thus enabling early retirement without relying solely on traditional employment income. To learn more about increasing your cash flow, read our blog: Maximizing Cash Flow from Investment Properties: Tips and Tricks for Investors.

Factors Influencing the Number of Properties:

The number of cash-flowing properties an investor needs to retire early depends on several key factors:

- Financial Goals: The desired level of passive income in retirement will significantly impact the number of properties required. A more lavish lifestyle will necessitate a larger portfolio.

- Property Cash Flow: The amount of positive cash flow generated by each property is crucial. High cash-flowing properties require fewer acquisitions to achieve retirement goals.

- Geographical Location: The real estate market and cost of living vary by location. Investing in properties in regions with higher rental yields can impact the number of properties needed.

- Market Conditions: Real estate markets can fluctuate. A robust market might result in higher property prices but also increased rental income.

- Investor’s Risk Tolerance: Some investors prefer a conservative approach, aiming for a greater number of properties with lower risk, while others might opt for riskier, higher-return properties.

- Leverage: Financing properties through mortgages can amplify returns but also increases risk. The balance between leveraging and minimizing risk influences the number of properties required.

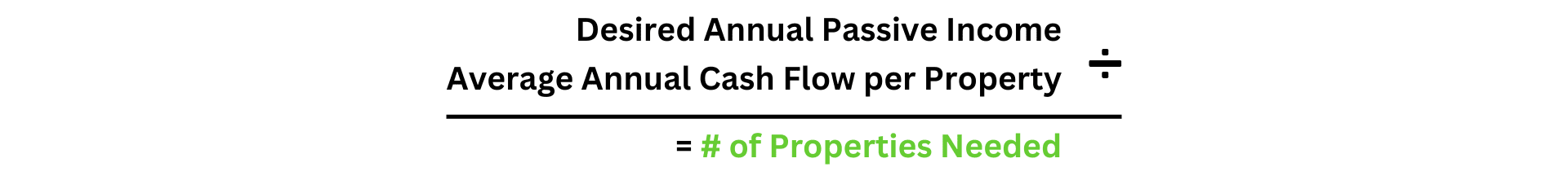

Formula for Assessing Cash Flow vs. Expenses

To determine how many cash-flowing properties you need to retire early, you can use the following formula:

Here’s how to break down the formula:

- Desired Annual Passive Income: Calculate the amount of money you need annually to sustain your desired lifestyle in retirement. This includes all living expenses, such as housing, healthcare, food, travel, and entertainment.

- Average Annual Cash Flow per Property: Estimate the average positive cash flow generated by a single property after deducting all expenses.